Before you begin data entry check that your company/business details are setup correctly.

Company Details

The information on this screen will contain some of the details you would have provided on registering for the application. You should make sure that the details are correct and up to date before starting data entry.

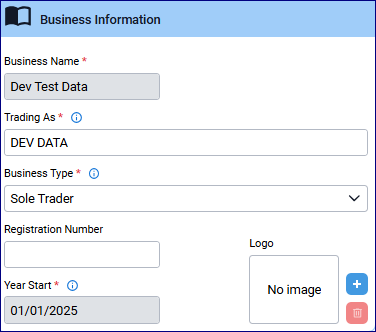

From the main menu, go to Settings > Company Detail>Business Information

- Business Name: Enter the name of the business.

- Trading As: If you wish to display a different name on your stationery, such as Invoices, enter this here.

- Business Type: Select the appropriate type for your business. Refer to your accountant if unsure. Note: If your appropriate business type is not available please contact us.

- Sole Trader

- Partnership

- Limited Liability Company

- Limited Liability Partnership

- Public Limited Company

- Registration Number: If relevant, enter your company registration number.

- Year Start: Enter your year start date or the day you wish to begin your data entry. Caution: you cannot change this once you have entered a transaction.

- Logo: click on the plus sign to add your company logo

Address details

Contact details

VAT Details

- VAT Registered: If your business is VAT registered turn on the toggle to show the above details. When the toggle is off, this will remove the VAT fields from your data entry screens and all transactions will default to outside the scope of VAT.

- HMRC Gateway ID: This is just so that you have a reminder of your Gateway ID; it does not have to be filled in.

- VAT Prefix: Enter the country code prefix for your VAT. Enter GB for United Kingdom (excluding Ireland).

- VAT Registration Number: Enter your VAT number.

- VAT Basis: Select if your VAT return should be calculated on Invoice date or Payment date (Cash).

- VAT Frequency: Select the frequency you submit your VAT return.

- VAT Registration Date: This date is for information purposes only and is not used anywhere, however it can be very easy way to find the information in the future if needed.

- VAT Submission: This defaults to Submission - single company and only needs to be changed in if you are doing Group VAT submissions.

- Reset Authentication: This will only be available to users with Client Administrator role. This will clear the MTD for VAT access token for this company and require you to provide authorisation with HMRC again in order to submit your VAT returns via MTD.

(Note: If you are unsure about any of your VAT details, please refer to your accountant)

Once you have checked and updated all your company details, Save the changes you have made.

Was this article helpful?

That’s Great!

Thank you for your feedback

Sorry! We couldn't be helpful

Thank you for your feedback

Feedback sent

We appreciate your effort and will try to fix the article